Seniors Await Supreme Court Decision on Student Loans

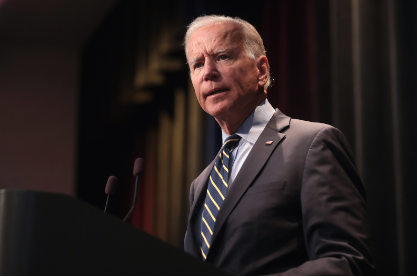

President Joe Biden’s plan to have the federal government forgive up to $20,000 in student loans for individuals in certain income brackets is currently in a confusing state. The conservative-majority Supreme Court is hearing oral arguments in cases that have called the forgiveness program “executive overreach” and therefore unconstitutional.

26 million people applied for forgiveness, and now the status of their debt payments are in limbo. While the students of Stone Bridge are not yet in that confusing state, paying for college is on the mind of many, particularly seniors who are getting ready to pursue higher education. Senior year is already a stressful time for students, but considering the sky-high cost of a degree has only added to the anxiety for some.

“I feel like [the cost] is a big part of what a lot of students going into college consider,” senior Swathi Vijayakumar said. “Paying off debt seems really hard these days. I’m definitely going to have to take a loan out and I’m really worried [about] how I’m going to pay it off.”

High tuition costs have also hindered students from attending their dream schools and the institutions that would advance their careers the best. The average cost of a bachelor’s degree at an American university was $35,551 in 2022 — up 295.2% from 1963. That does not consider out-of-state tuition, which can be double or triple the standard fees.

“I was less inclined to apply out of state,” senior Nikita Majumdar said. “Especially to schools that had really good programs out of state because of the cost.”

While more affordable options exist, like community college or taking a gap year to work, stigma can dissuade students from taking advantage of these legitimate opportunities. The balancing act between affordability, academics, and reputation has left SBHS seniors with difficult decisions.

“I really just don’t appreciate this culture of having to go to a prestigious school,” senior Safiyah Fatima said. “It’s this external pressure. I just need to go and get a degree that will help me get a job. I feel like the college choice should be about the right fit of the school, not the cost.”

Student debt is also a weight on families, with many working parents still paying off their own degrees as well as the education of their older children. There are millions of Americans with student debt across all age brackets, with the most in people between 25 and 34.

“Knowing that my parents were still trying to help my [older] brother pay off medical school debt impacted my decision,” Majumdar said. She is currently planning on attending the University of Virginia. “I had to be more conscious about where I am going to spend, regardless of tuition, like even just living expenses.”

The situation of student loan forgiveness is complex and tense. But the fear of debt hanging over them for the rest of their lives has seniors seeing the appeal of President Biden’s plan.

“Any loan forgiveness would be really helpful, obviously,” Majumdar said. “I think the financial burden of education would be lifted and it would open up a lot of channels not only for me, but also a bunch of people who don’t really have access to higher education.”